Liquidity Management by Islamic banks

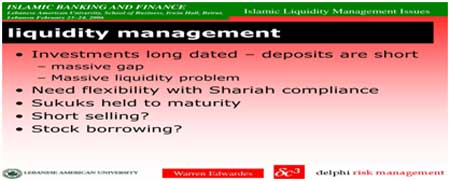

Financial markets can be analyzed by using the theories of supply and demand. Those who save money (or make financial investments, which is the same thing), whether individuals or businesses, or banks are on the supply side of the financial market. Those who borrow money are on the demand side of the financial market. Money market equilibrium occurs at the interest rate at which the quantity of money demanded equals the quantity of money supplied. All other things unchanged, a shift in money demand or supply will lead to a change in the equilibrium interest rate and therefore to changes in the level of real GDP and the price level. If demand increases and supply remains unchanged, then it leads to higher equilibrium price and higher quantity. If demand decreases and supply remains unchanged, then it leads to lower equilibrium price and lower quantity. Hence liquidity management by banks and central bank is very important in controlling inflation and in increase of GDP growth.

The prime tools for liquidity management by Islamic banks are Tawarruq also called ‘Commodity Murabaha’ and hedging through derivatives, although the latter category is basically a part of risk management, not the LM technique. In many parts of the world, Islamic banks mobilise deposits against fixed returns through tawarruq and / or commodity platforms and then deploy the funds again on the basis of tawarruq, or so called hedging through financial derivatives. Tawarruq is being used in varying degrees in all countries

For inter-bank market, CBOS encourages banks to cooperate and coordinate together to unify their financing and exchange rate policies, establish LM monetary funds, and to securitize their capital assets. LOLR facility is provided by using the Liquidity Deficit Window (LDW) and the Investment Financing Window (IFW) on Mudaraba or musharaka basis.

At LDW, if the receiving bank repays the finance within seven days, it is exempted from paying any profit to CBOS. But if it exceeds the seven days, profit is distributed between rabbulmal and mudarib based on 90% to CBOS and 10% to mudarib.

At IFW, the CBOS raises tender for banks that are awarded to banks based on profit percentage of mudarabah. Thus, the central bank is no longer involved in the daily liquidity requirements of the banks except as LOLR. Member banks are required to put in capital a combination of a minimum 40% cash contribution and 60% in a form of investment securities or Sukuk.

In Pakistan, SBP allows IBIs’ exposure in Bai Muajjal of Sukuk with GOP to be eligible for SLR. As such sukuk cannot be sold before maturity due to being receivables, their SLR eligibility has significantly increasd the stability risk of IBIs and the industry.

Organised Tawarruq / Commodity Murabaha / Sukuk Murabaha Tawarruq can be defined as getting cash or investing cash by way of trading as a contrivance while the subject of the exchange is not the objective. Almost all contemporary jurists allowed juristic tawarruq in unavoidable cases where a person may buy a commodity on deferred payment and sell it on spot (to any third party) to get (less) cash while fulfilling the conditions pertaining to transfer of ownership and possession. In case the commodity sold is bought back by the seller, it is ‘eenah, prohibited by overwhelming majority of jurists, But, what Islamic banks do is ‘organized tawarruq’ in which they buy and sell any commodities or instruments through broker(s) without fully observing the trade related conditions.

murabaha or commodity/ sukuk murabaha represents around 60% of the Islamic banks’ financing services around the world. What is currently being done in the name of interbank bai muajjal of sukuk in Pakistan is practically ‘eenah. A broker facilitates an Islamic bank and two conventional banks; sukuk are purchased by Islamic bank from conventional bank ‘A’ on spot payment to sell instantly to conventional bank ‘B’ on deferred murabaha; the latter bank uses them for tawarruq and arbitrage. If placement of liquidity is the issue, Islamic bank should keep such sukuk, preferred profitable instrument, but it sells onward just because bank ‘A’ is assured by the broker that the Sukuk will reach back the same day before close of business. The fact that ‘A’ doesn’t exclude the sold Sukuk from its SLR securities implies that SBP also becomes a part of the contrivance. Shariah board / advisors are happy with merely a note that ‘B’can hold or sell the sukuk at its discretion.

Such tawarruq is invalid according to Islamic Fiqh Council (IFC, Resolution in 2009) Jeddah, AAOIFI and Shariah bodies like DSN (National Sharia Board) of Indonesia, except a few. Allowed exceptionally by some scholars for extreme and case-by-case situations, tawarruq has turned into a retail product for ordinary customers. It is neither the spirit nor even the letter of Islamic finance.

It runs against economic logic, because it employs artificial sales contract as a façade to camouflage the conventional nature of transactions. But, the reality is that organised tawarruq is being widely used in Malaysia, UAE, Bahrain, Pakistan and other parts of the world. For deposits taking and placement of excess liquidity in the international market, there are currently three commodity Murabaha platforms including Bursa Malaysia, DMCC Dubai and London Metal Exchange.

In other jurisdictions, tawarruq is used through non-standardised procedures involving broker(s). It involves heavy cost of commodity or sukuk brokerage without adding any real value whatsoever against the risk free returns both to Islamic and conventional banks involved. Bursa Suq Al-Sila’ (BSAS) launched in Malaysia in 2009 facilitates Islamic interbank placements, deposit-taking, financing, Islamic profit rate swap, cross currency swap, Sukuk issuance, as well as debt trading with commodity using the concept of Murabahah for Tawarruq.

In Pakistan, the Shariah board of the Meezan Bank approved the guidelines for developing a commodity Murabaha platform at Pakistan Mercantile Exchange (PMEX) [Business Recorder, March 9, 2017]. It is important to observe that the proposed process of commodity murabaha at the PMEX has not been approved by the Shariah boards of the SECP and the SBP. It seems that the responsibility of allowing such products has been shifted to the premier Islamic bank of the country that once practically involved would automatically be followed by the market .

Shoaib Umar, a senior Islamic finance professional working with the Central Bank of Bahrain discussed in detail as to why the regulators must stop the use of tawarruq). His conclusion is based on seven reason: i) Tawarruq creates a disconnect between the real and financial economy; ii) It is a parasite in the system debt accumulation without economic growth; iii) It is identical to the interest-based system in terms of consequences; iv) It increases systemic risk due to unhealthy financial innovation difficult to be regulated due to being more complicated than conventional system; v) It is hindering the genuine growth of Islamic finance; vi) It is immoral as Islamic banks end up collecting the liquidity for Islamic business and placing it with conventional banks for arbitrage; and vii) practically, the proper murabahah structure is not followed, constructive or actual possession of the commodity is rarely obtained by the customer.

So we need to do lot of changes in this respect.