Tawarruq as Liquidity management tool in Islamic Banking and Finance

Liquidity management has emerged as most needed tool for the Islamic Banks to do their business and for the country to use it as monetary management tool to tackle inflation and unemployment.

State Bank has started using Tawarrup as its main tool to absorb and inject funds in to Islamic Banking area. But its size is very limited till now.

In April 2020 size of Bai Muajjal is just Rs 177 billion. In sukuk (Islamic Bonds) their size in June 2020 is Rs 147 billion as compared to Rs 385 billion in June 2018.

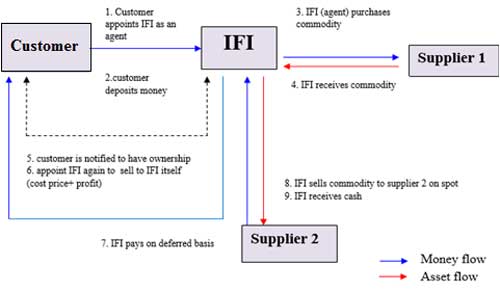

What tawarruq means. It is just selling something on deferred basis and then buying it back in cash, albeit at a lower price than the deferred price.

The effectiveness and efficiency of liquidity management mechanism in fact depends upon banks’ ability to resort to high quality coupled with islamically accepted financial instruments that are tradable and marketable in the inter-bank money markets.

Thus, the introduction of commodity murabahah instrument based on tawarruq concept was first made by Central Bank of Malaysia as an innovative approach to liquidity management. It certainly adds to the list of Shariah-compliant instruments for Islamic banks to manage their liquidity more effectively and efficiently. Under this Commodity Murhabah Product (CMP) mechanism, if Islamic banks face liquidity risk in the form of short-term funding difficulties, they can always raise funds on the money market based on Shariah principles. More importantly, since it is based on the internationally accepted structure, CMP has the potential to be marketed abroad which further supports cross-border transactions of Islamic financial institutions in a globalised world and to ensure market liquidity.

In Malaysia, the establishment of the first Islamic Inter-bank Money Market (IIMM) on January 3, 1994 ( still not in existence in any other country) was designed to provide the Islamic banks with the facility for funding and adjusting portfolios over the short-term and hence maintaining the funding and liquidity mechanism necessary to promote stability in the system. More importantly IIMM provides avenue for Islamic banks to manage liquidity more effectively and efficiently without undermining the principles of Shari`ah.

Contrarily there are various short-term liquidity instruments in the conventional money market, offering different returns with different tenors. These instruments include treasury bills, certificates of deposits, repurchase agreements, banker’s acceptance, commercial papers and inter-bank money deposits. All these instruments have different characteristics pertaining to maturity periods ranging from over night to one year. In a nutshell, inter-bank money market allows surplus banks to channel funds to deficit banks using various instruments, thereby maintaining the funding and liquidity mechanism necessary to promote stability in the system. However, most of these instruments used in inter-bank money market are essentially interest-based instruments.

Therefore, the establishment of a viable Islamic money market with Shariah compliant instruments is not only needed for the smooth growth of the industry now a days but it has already become a necessity.

Commodity murabahah is one of the most popular techniques used to manage short-term liquidity in the Gulf region especially Saudi Arabia and United Arab Emirates. It is based on commodities traded on the London Metal Exchange (LME) on a spot basis with 100 per cent payment of the purchase price, then selling the purchased commodities to a third party on a Murabahah (cost-plus sale) basis for a deferred payment with a maturity from one week to six months, and with spot delivery of the sold commodities.

Now Pakistan has introduced it but still it is at its nascent stage. They have to further refine it. One of the steps is that Government may raise its borrowing through Sukuk instead of conventional instruments. This would obviously increase the size of Tawarruq and Islamic Money Market.

However, it is important to note that throughout these cyclic variations, the urine Cl remains low cytotec 200mg pills generic Meta analysis on treatment of non small cell lung cancer with brucea javanica oil emulsion in combination with platinum contained first line chemotherapy